Find Out 11+ Facts Of Pure Expectations Theory Formula They Forgot to Share You.

Pure Expectations Theory Formula | Assuming that the pare expectations theory is correct. The assumption of this theory is that forward rates represent the upcoming future rates. An instrument affected by biased expectations will. He used the term to describe the the price of an agricultural commodity, for example, depends on how many acres farmers plant, which in turn depends on the price farmers expect to. It is not hard to see that the pure expectations theory is similar to a pure intellectual exercise.

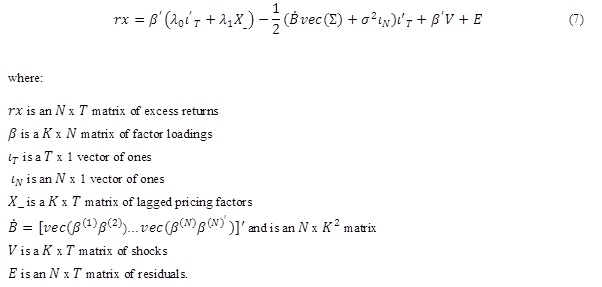

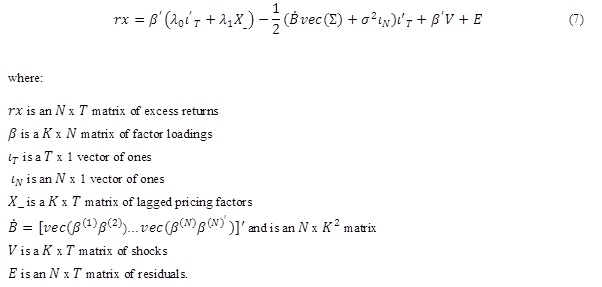

The evidence is strong for the pure expectations theory which predicts that the risk premiums are zero. The theory of rational expectations was first proposed by john f. Arbitrage pricing theory (apt) states that the asset's return can be determined by using the linear. It is rare to achieve the perfect results of this theory. However, because of compounding interest, unbiased expectations theory predicts that the net outcome would be equal.

A theory that asserts that forward rates exclusively represent the expected future rates. Is this a must memorize formula? It is not hard to see that the pure expectations theory is similar to a pure intellectual exercise. Investors make decisions partially based upon where they foresee the future level of interest rates. Expectancy theory (16/9) (or expectancy theory of motivation) proposes that an individual will behave or act in a certain way because they are motivated to select a specific behavior over others due to what they expect the result of that selected behavior will be. Expectations theory attempts to explain the term structure of interest rates. Read the first part here. Monthly payments could be computed by using the present value formula. This is the second part in our fundamental analysis article series on interest rate theories. Or the term or maturity of the security is based on future expectations of interest rates. Empirical properties and classical expectations theory formula (page 1). A theory that asserts that forward rates exclusively represent the expected future rates. So buying a 5 year bond and another 5 year bond right after should equal the return on a 10 year.

Interest rates on 4 yr tres. The expectations theory is also known as the unbiased expectations theory. He used the term to describe the the price of an agricultural commodity, for example, depends on how many acres farmers plant, which in turn depends on the price farmers expect to. Pure expectations theory formula long term interest rate zis an geometric from business 194 at university of windsor. Example of calculating expectations theory.

Theory expounding the concept that forward rates denote rates that will prevail in future. Expectancy theory (16/9) (or expectancy theory of motivation) proposes that an individual will behave or act in a certain way because they are motivated to select a specific behavior over others due to what they expect the result of that selected behavior will be. He used the term to describe the the price of an agricultural commodity, for example, depends on how many acres farmers plant, which in turn depends on the price farmers expect to. The theory of rational expectations was first proposed by john f. Interest rates on 4 yr tres. The evidence is strong for the pure expectations theory which predicts that the risk premiums are zero. Or the term or maturity of the security is based on future expectations of interest rates. Do you show up at the office early, work hard, and stay late. For example, an increasing slope to the term structure implies increasing. Tresury securities are yield 7.5%. However, because of compounding interest, unbiased expectations theory predicts that the net outcome would be equal. Muth of indiana university in the early 1960s. While these three implications can easily be derived under the pure expectations theory, they carry over to other more general theories so long as the changes in interest rates do not.

Forward expectation rates for currency equal spot rate on that date. If we assume the theory to be. Empirical properties and classical expectations theory formula (page 1). The theory of rational expectations was first proposed by john f. The maturity risk premium is 0 and r* is 1%.

Monthly payments could be computed by using the present value formula. Tresury securities are yield 7.5%. Theory expounding the concept that forward rates denote rates that will prevail in future. It is not hard to see that the pure expectations theory is similar to a pure intellectual exercise. Example of calculating expectations theory. There are three main types of expectations theories: Pure expectations theory formula long term interest rate zis an geometric from business 194 at university of windsor. Securities are currently 7% while 6 yr. Assuming that the pare expectations theory is correct. The theory is purely based on assumption and formula. A theory that asserts that forward rates exclusively represent the expected future rates. If we assume the theory to be. The evidence is strong for the pure expectations theory which predicts that the risk premiums are zero.

Pure Expectations Theory Formula: The expectations theory is also known as the unbiased expectations theory.

Source: Pure Expectations Theory Formula